Anxiety has been the watchword in the government workforce for almost two years now. While that anxiety began as an outgrowth of the pandemic and then the Great Resignation, it has persisted and continues to evolve.

MissionSquare Research Institute started surveying state and local government employees in May 2020 about the job, financial, and personal impacts of COVID-19, and has since conducted three follow-up surveys. In September of 2022, the Institute fielded a quick-pulse survey focused on public sector employees’ retirement outlook.

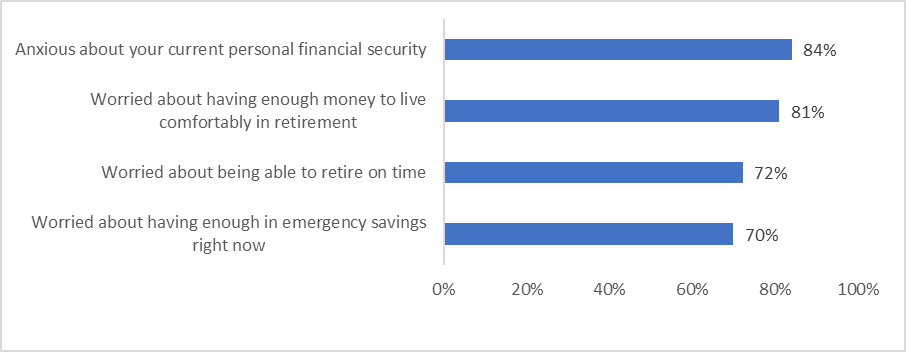

The new survey indicates that 84% of employees say that current economic conditions and market volatility make them feel anxious about their personal financial security.[i] This anxiety feeds directly into concerns about their ability to live comfortably in retirement (81%) or to retire when they plan to (72%). In addition, 70% of employees also expressed worries about having enough set aside to cover emergency expenses. In general, only 41% of state and local human resource directors have indicated that they feel their employees are financially prepared for retirement.[ii]

As employers are looking to weigh the impacts of current economic conditions on various segments of their workforce, those expressing such concerns were more likely to be female and/or not have a college degree.

The practical implications of these concerns are felt by both the employees and their employers. For employees, aside from the feeling of economic anxiety, there is a sense of additional workload falling to them as coworkers have left the organization, with 78% saying this has resulted in a strain on their workload.[iii] Even before the pandemic, 83% of employees were worried about their finances, and 66% were carrying those worries with them into their workday.[iv] For employers, that can be both a distraction and a contributor to reduced morale.

One of the more interesting differences between employees’ views and those of human resource managers is around the value of benefits. While 85% of HR managers indicated that the benefits compensation offered (in health insurance, retirement, and other programs) is competitive with the overall labor market,[v] only 42% of employees said their retirement benefits were better than those offered in the private sector (35% said they were about the same). When directly comparing types of benefits, a slightly greater percentage of employees said they were more inclined to stay with their current employer based on non-retirement benefits such as health care (62%) than based on retirement benefits (58%).

This may indicate that public sector employers with a more generous retirement or total benefits package compared to the private sector might fare better in recruitment and retention by more clearly communicating the full value of those benefits to their job candidates and current staff.

Other actions employees suggested that could assist in the current financial environment were to increase salaries, improve retirement benefits or related employer matching, and improve retiree healthcare benefits. In the Institute’s November/December 2021 survey, employees also cited the importance of providing recognition for their valuable role in the organization – a result that dovetails with the 59% who said they value serving their community during this difficult time.[vi]

For the workforce as a whole, the U.S. Census Bureau found a slightly higher percentage planning to retire early compared to the percentage postponing retirement, with those working in education or those in poor health more likely to retire early.[vii]

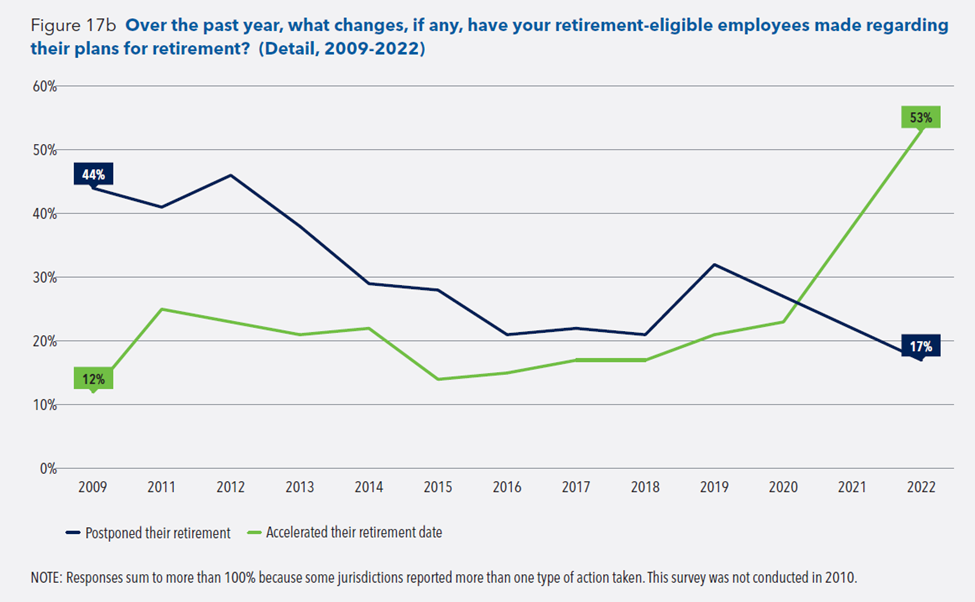

State and local government human resource managers have seen a more profound shift over the past thirteen years, with the share reporting that employees are accelerating retirement plans increasing from 12% to 53%, as the share reporting employees postponing retirement has declined (see Figure below).[viii]

Taken together with the large numbers of employees departing due to retirement or resignation, the anxieties being expressed by government workers create an incentive for their employers to address related financial concerns. This could be through direct action on compensation structures or through financial education or other communication around the full value of salaries and benefits, or some of both in combination with other steps to better engage employees, acknowledge the stresses they are experiencing, and recognize their contributions to public service.

Dive Deeper

MissionSquare Research Institute is continuing its survey series on the current economic and public service workforce conditions and will be releasing additional reports later this fall and winter. Learn more about our latest research.

About the Author:

Gerald Young, Senior Research Analyst, MissionSquare Research Institute.

[i] Inflation, Market Volatility, and Retirement: How Employer Benefits Can Help Public Sector Worker Anxiety Over Current Economy, MissionSquare Research Institute, 2022. Except as otherwise noted, all other research findings discussed in this article are also based on this state and local employee survey.

[ii] State and Local Workforce Survey 2022, MissionSquare Research Institute

[iii] Continued Impact of COVID-19 on Public Sector Employee Job and Financial Outlook, Satisfaction, and Retention, MissionSquare Research Institute, 2022.

[iv] Survey Results: A Focus on Public Sector Financial Wellness Programs, MissionSquare Research Institute, 2020.

[v] State and Local Workforce Survey 2022, MissionSquare Research Institute

[vi] Continued Impact of COVID-19 on Public Sector Employee Job and Financial Outlook, Satisfaction, and Retention, MissionSquare Research Institute, 2022.

[vii] Pandemic Disrupted Labor Markets but Had Modest Impact on Retirement Timing, U.S. Census Bureau, 2022.

[viii] State and Local Workforce Survey 2022, MissionSquare Research Institute