Over the course of the pandemic, there’s been a growing demand for city officials to acknowledge the disparities in the delivery of services across different departments to people of diverse racial and ethnic backgrounds. This work is neither glamorous nor easy, but with time, resources, and committed partners – such as community members, philanthropic organizations, and business leaders – tangible results are possible.

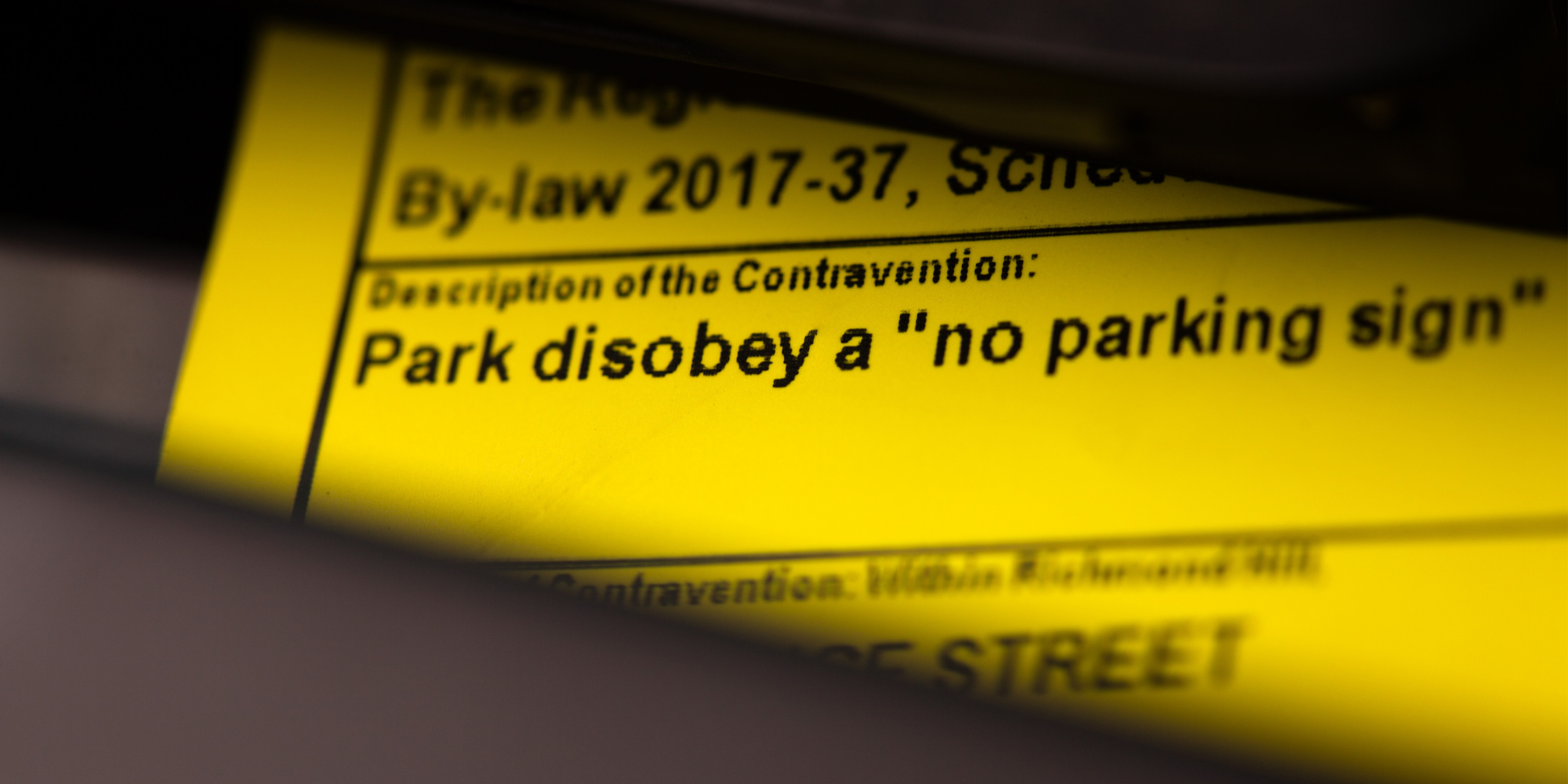

Some cities and court systems are centering equity by attempting to reconcile the disproportionate impact that court debts have on residents of color with local government’s reliance on fines and fees to fill budget gaps. With support from JPMorgan Chase, NLC created the Cities Addressing Fines and Fees Equitably (CAFFE) initiative in 2019 to propel long-term change for residents who are at risk of losing income and assets, and entering the judicial system, and instead providing onramps to financial empowerment services and supports.

CAFFE has led the way in helping cities use data and less punitive approaches to reduce the harmful effects of municipal fines and fees on residents’ financial health. Cities participating in CAFFE are targeting critical resources to vulnerable residents by measuring communities’ deficits and rates of infractions, misdemeanors, and felonies stemming from jaywalking, littering, disorderly conduct, red-light camera violations and other traffic citations to fund municipal operating expenses.

Five cities completed an assessment in the previous phase of CAFFE that unearthed complicated structures of fines and fees built on a foundation of inequity. While demographic data, especially race, was often missing from the city datasets, the CAFFE city assessments affirmed that Black individuals were considerably more likely to be impacted by the assessed fine or fee in their respective communities. These findings correlate with research conducted in 2016 by data scientist Dan Kopf reasoning cities with a high percentage of African American communities relied most heavily on court fines and fees. Race, not a city’s poverty rate, was the single biggest factor.

Supporting the Next Phase of CAFFE

Beginning this month, NLC is launching a new cohort of cities to expand on the learnings from the first cohort, delving more closely into innovative court sanctions that provide restorative justice and accountability, while also examining the ability to pay and equitable practices within city departments that levy fines and fees and collect payments.

NLC invited Sarah Willis Ertur, Head of Financial Health, Global Philanthropy at JPMorgan Chase to share her thoughts on the decision to support CAFFE again and its role in addressing the financial health of residents.

How is JPMC addressing systemic issues by supporting the financial health of city residents and ensuring equitable outcomes?

When approaching financial health and considering what programs JPMC will support, we don’t start by considering a singular issue area such as increasing short-term savings, reducing debt, or building credit. We start with an analysis of systems that are having a profound impact on people’s financial lives – in this case, the court system. Sub-optimal outcomes persist because they are rooted in systems that impact every part of our financial lives such as financial services, housing, small business ownership, employment, public and private benefits, healthcare, etc. Additional stressors like the rising cost of living, involvement with the criminal justice system, and climate change have left more households financially vulnerable.

To remove the onus placed on individuals to navigate an imperfect system, JPMC endeavors to support “win-win” programs that reduce disparities and provide a better financial foundation for both cities and their residents.

As we’ve seen through NLC’s first CAFFE cohort, the ability to reduce disparities and provide a better financial foundation for residents is bolstered by NLC’s work with city leaders who want to better understand sustainable financial health strategies. This starts with looking at the data, and the practices that place undue stress on residents’ financial health.

This work involves systemic change and needs thoughtful partnerships that center racial equity in addressing institutional racism and wealth inequities. How do you see the role of cities in advancing this agenda? What can cities do and why are they important in the broader ecosystem?

Whether it’s through our Annual Challenge, the firm’s 30-billion-dollar Racial Equity Commitment, or through the Financial Health portfolio – we look to support cities as centers of economic opportunity. In this case, the city leaders and their offices are a source of innovation. Their willingness to forge new paths, comb through the data and identify sources of financial stress for their residents make cities a key partner. Such was the case in St. Paul, a city in the first CAFFE cohort. Through the initiative, the city worked to reform and eliminate some of the most harmful fees extracting wealth from communities – impound lot fees after a large snowstorm, library late fees, or reducing business license fees to promote economic growth.

What resonated most for you in the prior project that ended in early 2021 and what would you like to see replicated or expanded upon in this next phase of the work?

One thing that was clear in the last cohort was city leaders’ unwavering dedication to doing right by their communities, uncovering practices that were resulting in harm to the financial health of their residents, and letting the data drive the ultimate solution. We are supporting NLC’s expertise and relationships with cities across the country to look at ability-to-pay rules, how to incorporate financial empowerment strategies into collections strategies, or allow alternative methods of payment – all with the goal to improve economic opportunity for everyone in the community while also refining the ways cities recoup lost revenue resulting from the pandemic.

Selected Cities

The selected cities to participate in CAFFE are Birmingham, Alabama; Dallas, Texas; Las Vegas, Nevada; Maywood, Illinois; Montgomery, Alabama; Pueblo, Colorado; St. Louis, Missouri; and Washington, D.C.

Written in collaboration with Sarah Willis Ertur, executive director of global philanthropy, financial health for Corporate Responsibility with JPMorgan Chase & Co.