Co-Authored by Glencora Haskins and Mayu Takeuchi

Editor’s note: The total number of local governments studied in this analysis has changed from 332 (92 cities/consolidated city-counties and 240 counties with populations over 250,000) in the March 2023 data to 335 (92 cities/consolidated city-counties and 243 counties with populations over 250,000) in the June 2023 data.

The Department of the Treasury released updated data last month showing how state, local, territorial, and tribal governments are using $350 billion in pandemic relief funding provided by the 2021 American Rescue Plan Act (ARPA). The data on recipient appropriations, obligations, and expenditures through the end of June show how local governments are using federal funding to develop and execute their strategic priorities as the program’s December 2024 obligation deadline approaches.

For the last 18 months, Brookings Metro, the National League of Cities (NLC), and the National Association of Counties (NACo) have monitored how large metropolitan cities and counties have utilized $65 billion in State and Local Fiscal Recovery Funds (SLFRF) resources through the Local Government ARPA Investment Tracker. This post provides an update on how the local governments for Tier 1 cities and counties (with populations over 250,000) are implementing the SLFRF program, as well as an assessment of how federal dollars are being used to combat economic disadvantage.

Large Cities and Counties Committed 85% of Their SLFRF Dollars by June 2023

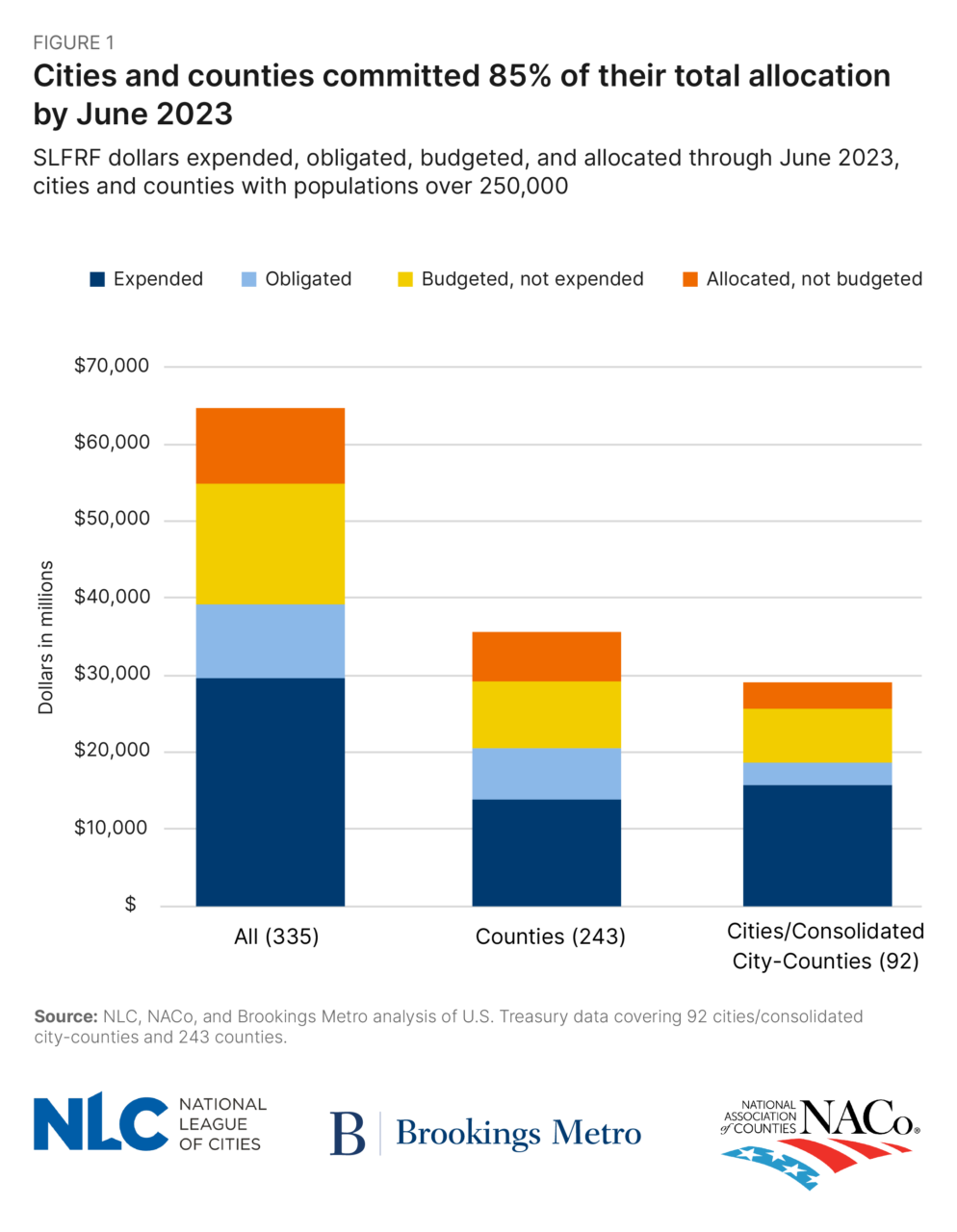

By the end of June 2023, 335 large cities and counties had committed SLFRF dollars to 13,268 projects, up from 11,771 projects at the end of March 2023 (a 13% increase). Large cities and counties appropriated $55 billion (85%) of their SLFRF dollarsacross these projects and had spent $30 billion of those appropriations. Consistent with previous local reporting, counties had committed a lower share of their allocations than cities, accounting for 53% of all appropriations despite representing a significant majority of project counts (70%)and receiving 55% of the $65 billion allocated to Tier 1 local governments. Counties also lagged cities in the share of funding they had obligated, indicating that cities are closer to fulfilling Treasury’s requirement that all SLFRF allocations be obligated by the end of 2024.1

Cities and Counties Continue to Prioritize Investment in Government Operations

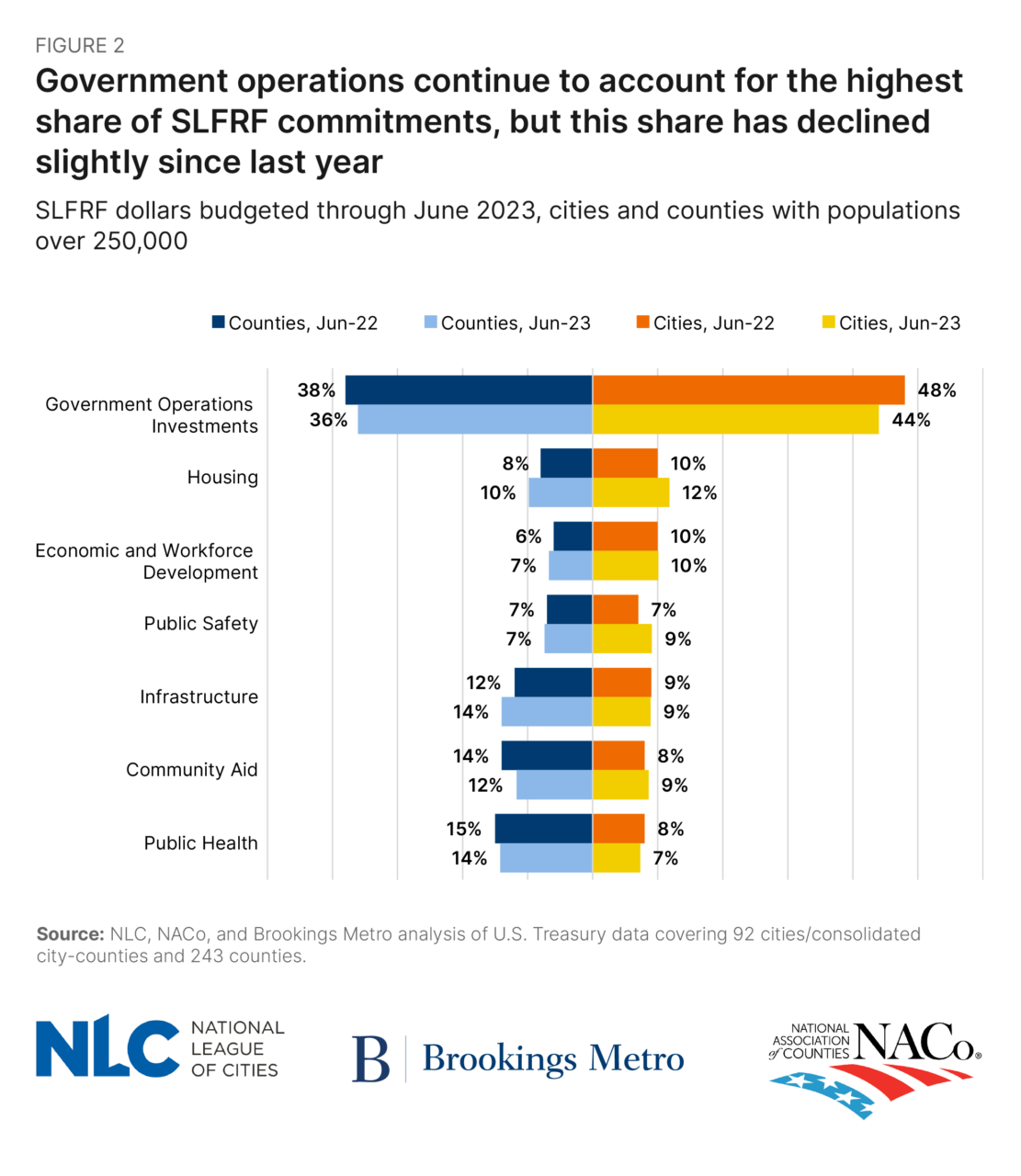

While appropriations across priority areas have continued to rise, government operations still account for 40% of SLFRF commitments by large local governments, the highest share of any category in our analysis. Cities and consolidated city-counties have consistently dedicated a larger share of their SLFRF commitments towards government operations than counties, who have committed more resources towards public health programs. Yet, the total share of commitments to government operations dropped slightly in both cities (48% to 44%) and counties (38% to 36%) between June 2022 and June 2023. This drop is the result of an increased share of commitments to housing projects in both cities and counties.

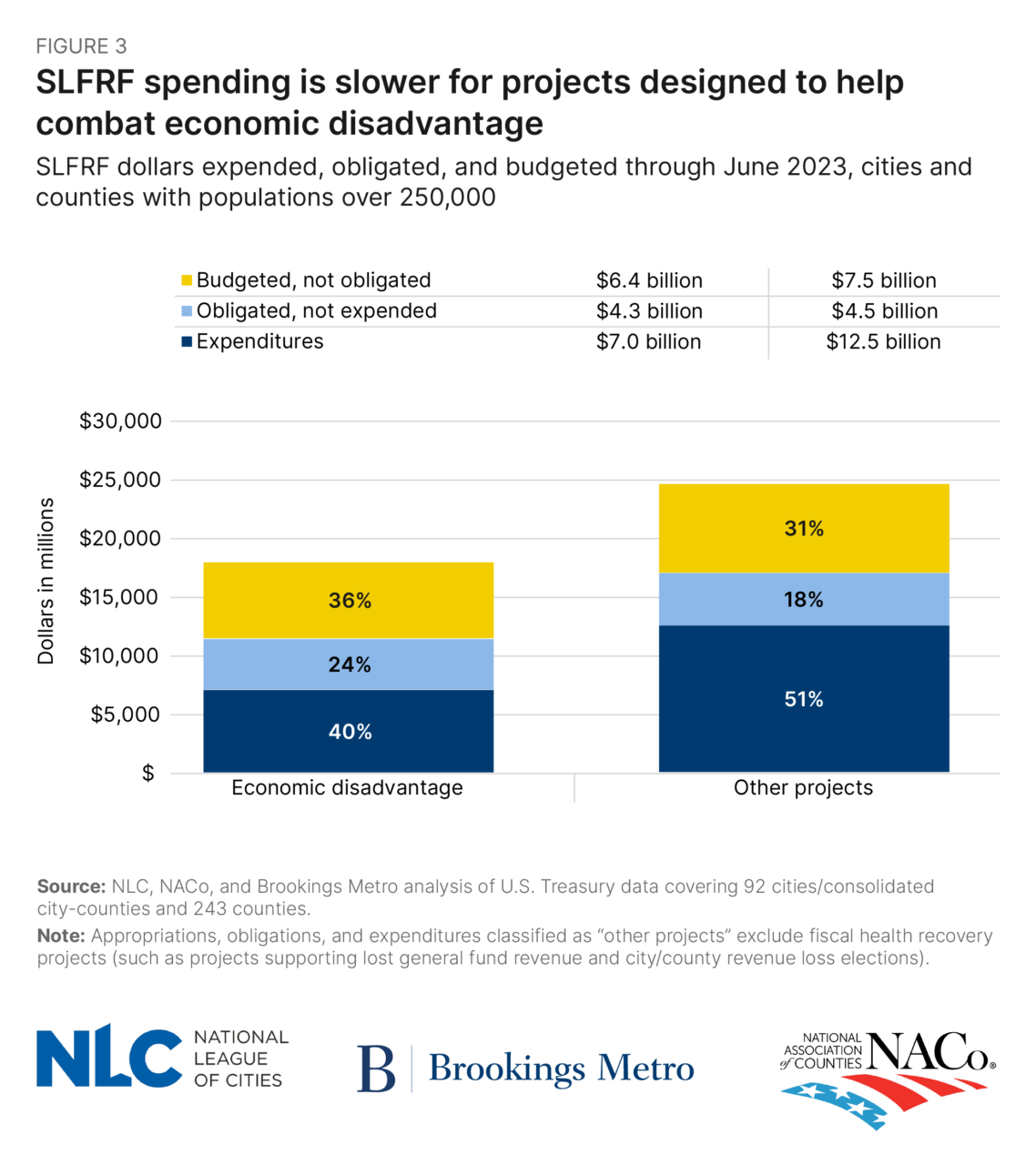

While the SLFRF program was designed as a pandemic relief package, the Treasury Department’s Final Rule allowed for these funds to be used to address long-standing health, social, and economic disparities, recognizing that these inequities exacerbated the impact of the pandemic in many of the U.S.’s most vulnerable communities. By the end of June 2023, large local governments had committed roughly $17.8 billion of their SLFRF allocations across programs that provide aid to disproportionately impacted communities, including projects that address housing insecurity, community violence, mental health, and substance abuse. These investments account for approximately one third of all SLFRF commitments made to-date.

These investments represent an impressive level of commitment by large local governments to addressing systemic inequality and disenfranchisement. Yet, the complex nature of designing and scaling new solutions to these problems has meant that expenditures in these domains have trailed expenditures in other spending categories. Despite comprising 32% of all SLFRF commitments by large local governments through the end of June, projects focused on addressing economic disadvantage made up 29% of all obligations made by these local governments, and just23% of all expenditures. In total, just 40% of all dollars committed to projects addressing economic disadvantage had been spent by the end of June, compared to over half of dollars committed to other types of initiatives (excluding funds appropriated to city and county general funds to replace lost revenue).

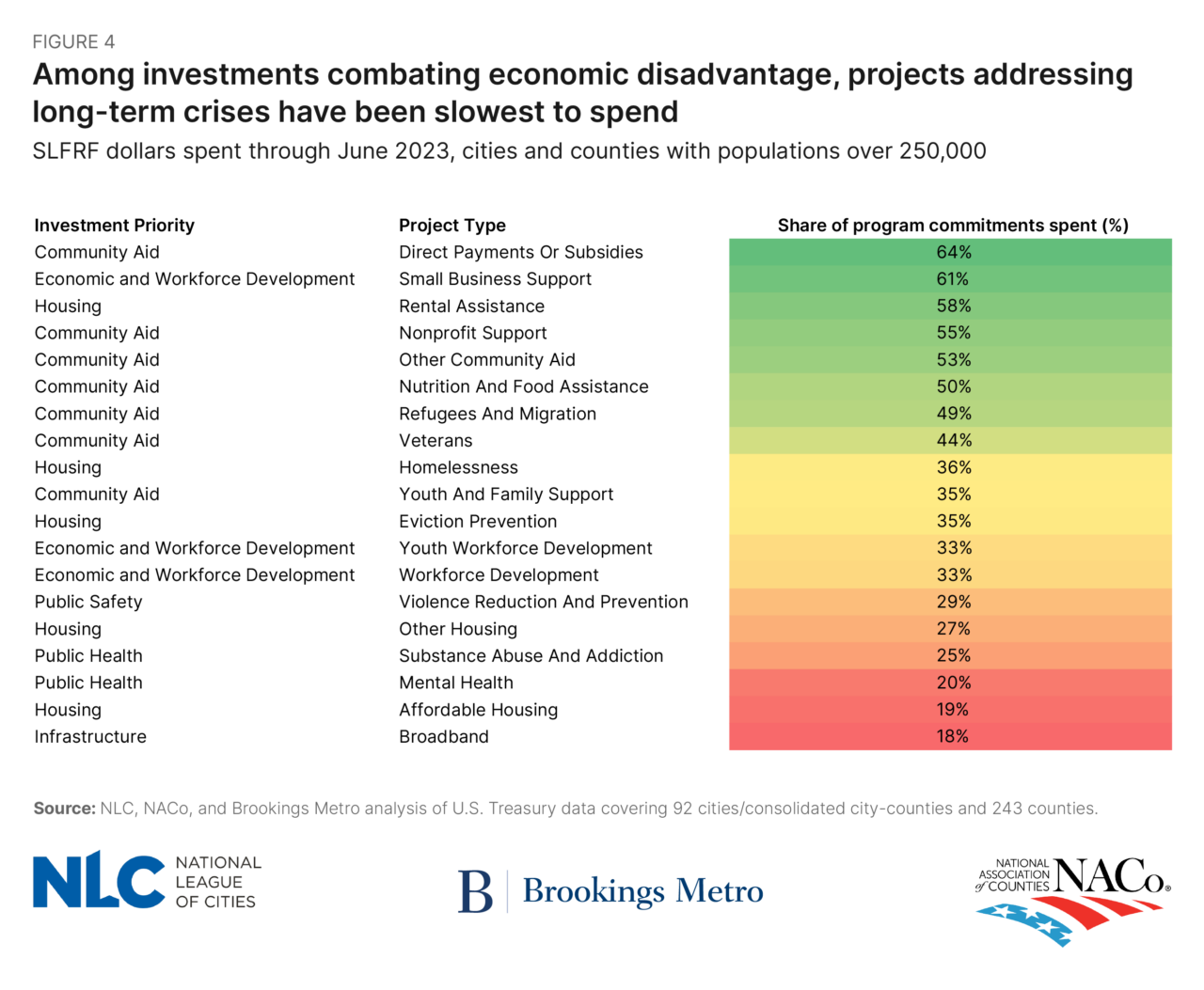

This trend supports findings from previous Brookings Metro research that local governments largely pursued “dual-track” investment strategies with their SLFRF allocations, first choosing to support emergency relief programs before investing in longer-term strategic priorities. Among SLFRF projects targeting economic disadvantage, investments in community aid and other acute, grant-based supports (like rental assistance and small business loans) were much more likely to have been obligated or spent. This contrasts with lower expenditure rates across long-term programmatic investments in mental health support, substance abuse prevention, affordable housing, and broadband expansion. These expenditure categories have a longer time horizon for desired impact, can be more capital-intensive, and require complex planning around program design, execution, and financial sustainability.

While local governments have until December 2024 to finish obligating their SLFRF allocations and until December 2026 to spend them, having these funds in their possession now provides a unique opportunity to address worsening community and public health crises, such as rising deaths by suicide and drug overdoses. Leaders in local government must continue to navigate competing pressures. On the one hand, they do not want to default to moving these dollars through channels of least resistance, reducing the potential of these strategies to be truly innovative and transformational. At the same time, moving too slowly to implement ambitious strategies for equitable economic recovery both risks cities and counties reverting to the status quo and jeopardizes their ability to capitalize on this funding opportunity within Treasury’s required timeline. Identifying ways to obligate these funds to projects that will allow them to address current crises is imperative if cities and counties are to capture this historic federal funding opportunity. Future Treasury data will reveal if—and how—cities and counties balance their need to implement transformational solutions for combatting economic disadvantage while managing heightened complexity and administrative time constraints.

The authors thank Alan Berube, Joseph Parilla, Teryn Zmuda, Christine Baker-Smith, Ricardo Aguilar, and Patrick Rochford for research advice and support.

| GLOSSARY OF TERMS ALLOCATIONS are the total funds distributed to state and local governments through the Coronavirus State and Local Fiscal Recovery Funds (SLFRF) program. AMERICAN RESCUE PLAN ACT (ARPA) is the $1.9 trillion economic stimulus and pandemic recovery legislation signed into law by President Joe Biden on March 11, 2021. This legislation is also referred to as the “American Rescue Plan” or “ARPA.” This brief focuses solely on the Coronavirus State and Local Fiscal Recovery Funds (SLFRF) program, and thus, “ARPA” and “SLFRF” are used interchangeably. APPROPRIATIONS are dollars distributed to state and local governments through the SLFRF program that have been budgeted or committed to specific initiatives or programs. In this brief, “appropriations”, “investments”, and “commitments” are used interchangeably. CORONAVIRUS STATE AND LOCAL FISCAL RECOVERY FUNDS (SLFRF) is the $350 billion program authorized by the American Rescue Plan Act (ARPA) that provides economic stimulus and pandemic recovery funding to U.S. states, territories, cities, counties, and tribal governments. This brief focuses solely on the SLFRF program, and thus, “ARPA” and “SLFRF” are used interchangeably. OBLIGATIONS are dollars distributed to state and local governments through the SLFRF program that have been legally dedicated to specific uses, frequently (but not exclusively) through contractual agreements. The Treasury Department’s newest guidance defines obligations as “orders placed for property and services and entry into contracts, subawards, and similar transactions that require payment”. The Final Rule requires recipient cities and counties to obligate 100% of their SLFRF allocations by December 2024. TIER 1 LOCAL GOVERNMENTS are metropolitan cities and counties with populations greater than 250,000. These jurisdictions are also referred to as “large local governments” or “large cities and counties.” |

1The Treasury Department’s definition for “obligations” has changed slightly since local governments reported their performance data through the end of June. For Treasury’s updated guidance on SLFRF obligations, see the November 2023 Obligation Interim Final Rule.