Municipalities have used the American Rescue Plan Act (ARPA) State and Local Fiscal Recovery Funds (SLFRF) to implement a variety of infrastructure projects to improve the lives of their residents, communities and economies by addressing the impact of the COVID-19 pandemic. Because of the SLFRF program’s flexibility, municipalities were able to use these funds to develop new or improve existing infrastructure to ensure continued access to government services and economic opportunity throughout the height of the pandemic. This includes expanding broadband to allow for remote work and online learning for students, removing lead pipes under roads to improve health outcomes, and improving public spaces, such as parks, to address local demand for open-air activities.

With less than a year left to obligate funds, localities can still use their SLFRF allocations to develop their transportation, water and broadband infrastructure projects in an equitable and sustainable way. The Biden administration, through their Justice40 initiative, is attempting to ensure that 40 percent of federal funding, which includes SLFRF, goes to disadvantaged communities. Local leaders with remaining SLFRF allocations can look for opportunities to advance their community’s infrastructure projects by focusing on investments in disadvantaged areas and considering an equity lens.

Notably, SLFRF allocations, unlike other means for financing infrastructure projects, are available now to local governments. Municipalities do not have to competitively apply for funding or pay back funds with accrued interest. For example, a municipality can use SLFRF before the obligation deadline to upgrade their water systems in addition to applying for their State Revolving Funds, which are mostly in the form of loans to communities. SLFRF gives municipalities a unique opportunity to combine dollars with other state and federal programs, such as through funding a required federal match needed to receive other infrastructure grants.

According to the NLC, Brookings Metro, and National Association of Counties’ (NACO’s) Local Government ARPA Investment Tracker, over one-third of SLFRF dollars allocated by Tier 1 cities and consolidated cities went towards a mix of infrastructure projects, taking a “whole of government” approach to budgeting rather than focusing on one single project. Almost one in five Tier 1 localities in the tracker allocated funding to public spaces to provide meaningful ways for residents to go outside during the pandemic. Close to one-quarter of Tier 1 cities in the tracker budgeted funds to the sewer and water subcategory, addressing public health concerns and the need for wastewater testing as one way to monitor the spread of COVID-19.

This blog highlights spending ideas for how to meet the 2024 obligations deadline if your community is still finalizing your ARPA allocations. Don’t forget that your city should ensure all your final plans are in compliance with Treasury’s Final Rule and reporting guidance.

Spending Opportunities

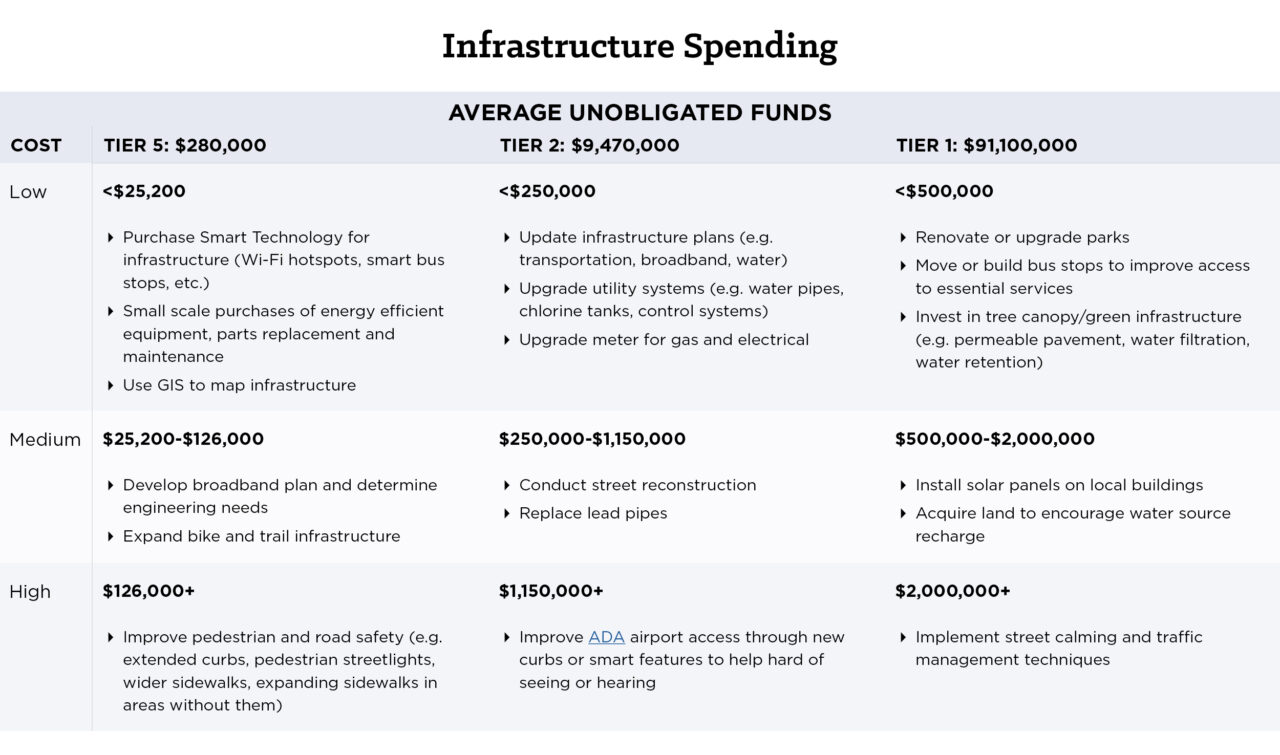

The following Spending Category Matrix presents multiple examples for different categories of spending (low, medium, and high cost) that can be utilized by governments of various tiers in obligating their remaining funds. The Infrastructure spending category was developed in partnership with NLC, Brookings Metro, and NACo for the Local Government ARPA Investment Tracker. This resource is another means for local leaders to find thousands of project ideas across tiers.

Local Spotlights

- Buffalo, NY allocated $10 million to expand the lead water service line replacement to an additional 1,000 homes, helping to improve quality of city’s housing and leading to better health outcomes for children. The city has already successfully replaced the lines in 500 homes and this expanded capacity will more than double its impact.

- Chandler, AZ allocated $4 million to replace and expand existing fiberoptic cabling and help increase resiliency of service and speed of operation.

- Chula Vista, CA invested $900,000 in stakeholder engagement efforts to inform the development of the Digital Equity & Inclusion Plan intended to address the local digital divide and to uncover opportunities for collaboration on digital equity projects.

Maximizing ARPA Funds for Long Term Infrastructure Investments with a Federal Match

With rising infrastructure costs, some projects may be unattainable depending on a municipality’s remaining available funds and the upcoming obligation deadline. Local governments can consider applying for other sources of federal funding through the Bipartisan Infrastructure Law, CHIPS Act, or Inflation Reduction Act and use their remaining SLFRF allocations as their federal match (often set at 20 percent or sometimes less for a disadvantaged community). Federal matches are often required for federal grants and with a range of grants available to municipalities of all sizes, local leaders can consider combining ARPA allocations with a federal grant for their infrastructure needs. Additionally, these federal grants align with the Biden Administration’s Justice40 initiative, which gives localities the unique opportunity to use these grants and their remaining SLFRF dollars to bring about equitable infrastructure changes or projects to their communities.

Glossary

American Rescue Plan Act (ARPA) is the $1.9 trillion economic stimulus and pandemic recovery legislation signed into law by President Joe Biden on March 11, 2021. This blog and its series focus on the Coronavirus State and Local Fiscal Recovery Funds (SLFRF) program; therefore, authors may use “ARPA” and “SLFRF” interchangeably.

Coronavirus State and Local Fiscal Recovery Funds (SLFRF) is the $350 billion program authorized by ARPA that provides economic stimulus and pandemic recovery funding to U.S. states, territories, cities, counties, and tribal governments.

Allocations are the total funds distributed to state and local governments through SLFRF.

Adopted Budget are dollars distributed to local governments through SLFRF that have been budgeted or committed to specific initiatives or programs.

Spent means the grantee has issued checks, disbursed cash, or made electronic transfers to liquidate (or settle) an obligation.

Obligations are dollars distributed to state and local governments through SLFRF that have been legally dedicated to specific uses, frequently (but not exclusively) through contractual agreements. The Treasury’s recent guidance defines obligations as “orders placed for property and services and entry into contracts, subawards, and similar transactions that require payment.” The Final Rule requires recipient local governments to obligate 100 percent of their SLFRF allocations by December 2024.

Tier 1 local governments are metropolitan cities and counties with populations greater than 250,000. These jurisdictions include states, U.S. territories, and counties but NLC’s focus for this series is on cities. These governments are required to report quarterly, and the last reporting date captured in our data is from September 30, 2023.

Tier 2 local governments are metropolitan cities with a population below 250,000 residents that are allocated more than $10 million in SLFRF funding, and NEUs that are allocated more than $10 million in SLFRF funding. These jurisdictions include counties but NLC’s focus for this series is on cities. These governments are required to report quarterly, and the last reporting date captured in our data is from September 30, 2023.

Tier 5 local governments are metropolitan cities with a population below 250,000 residents that are allocated less than $10 million in SLFRF funding, and NEUs that are allocated less than $10 million in SLFRF funding. These jurisdictions include counties but NLC’s focus for this series is on cities. These governments are required to report yearly, and the last reporting date captured in our data is from April 31, 2023.

Non-entitlement units (NEUs) are local governments that typically serve 50,000 residents or less. Of the $65.1 billion allocated to municipal governments across the country, SLFRF allocated $19.5 billion, or 30 percent, to NEUs. Comparatively, SLFRF allocated $45.6 billion, or 70 percent, to metropolitan cities. Depending on if an NEU is a Tier 2 or Tier 5 recipient, they may have different reporting requirements.

Acknowledgements: Thank you to Carolyn Berndt, James Brooks, Angelina Panettieri and Peyton Siler-Jones for their review of this blog. Thank you to Christy Baker-Smith, Julia Bauer, Irma Esparza Diggs, Josh Franzel, Patrick Rochford, Archana Sridhar, and Melissa Williams for their support and review of this blog.