Between January 2022 and June 2023, local governments across the country have allocated over $15 billion dollars in American Rescue Plan Act’s (ARPA’s) State and Local Fiscal Recover Funds (SLFRF) towards negative economic impacts, which often serve as means for community aid, across 10,000 projects. Cities, towns and villages have used these funds to support their residents in a variety of ways, addressing the immediate public health impacts of the COVID-19 pandemic as well as the longstanding inequities the pandemic further exacerbated. With these dollars, local leaders provided direct support to residents and their families as well as non-profits in many ways, from ensuring basic needs security to relieving medical debt to sparking innovation within community businesses and cultural institutions.

With the end of the federal public health emergency and associated aid, many communities continue to need investment and help to support their residents. For many residents, inflation led to unexpected costs for vulnerable communities, like individuals with low-incomes, people with disabilities, families and more. Likewise, in 2022 more than 13 percent of the nation faced food insecurity and rising costs at a time when congressional support for SNAP benefits has been on the decline. Additionally, localities are struggling to address the impact of population changes, both positive and negative, from 2020 and may remain particularly vulnerable to economic hardships.

As of September 2023, Tier 1 reporting cities and consolidated cities have obligated their funds to the following work:

- 29% to Youth and Family Support

- 28% to Other Community Aid

- 16% to Direct Payments or Subsidies

- 12% to Nutrition and Food Assistance

- 8% to Arts and Culture

- 7% to Nonprofit Support

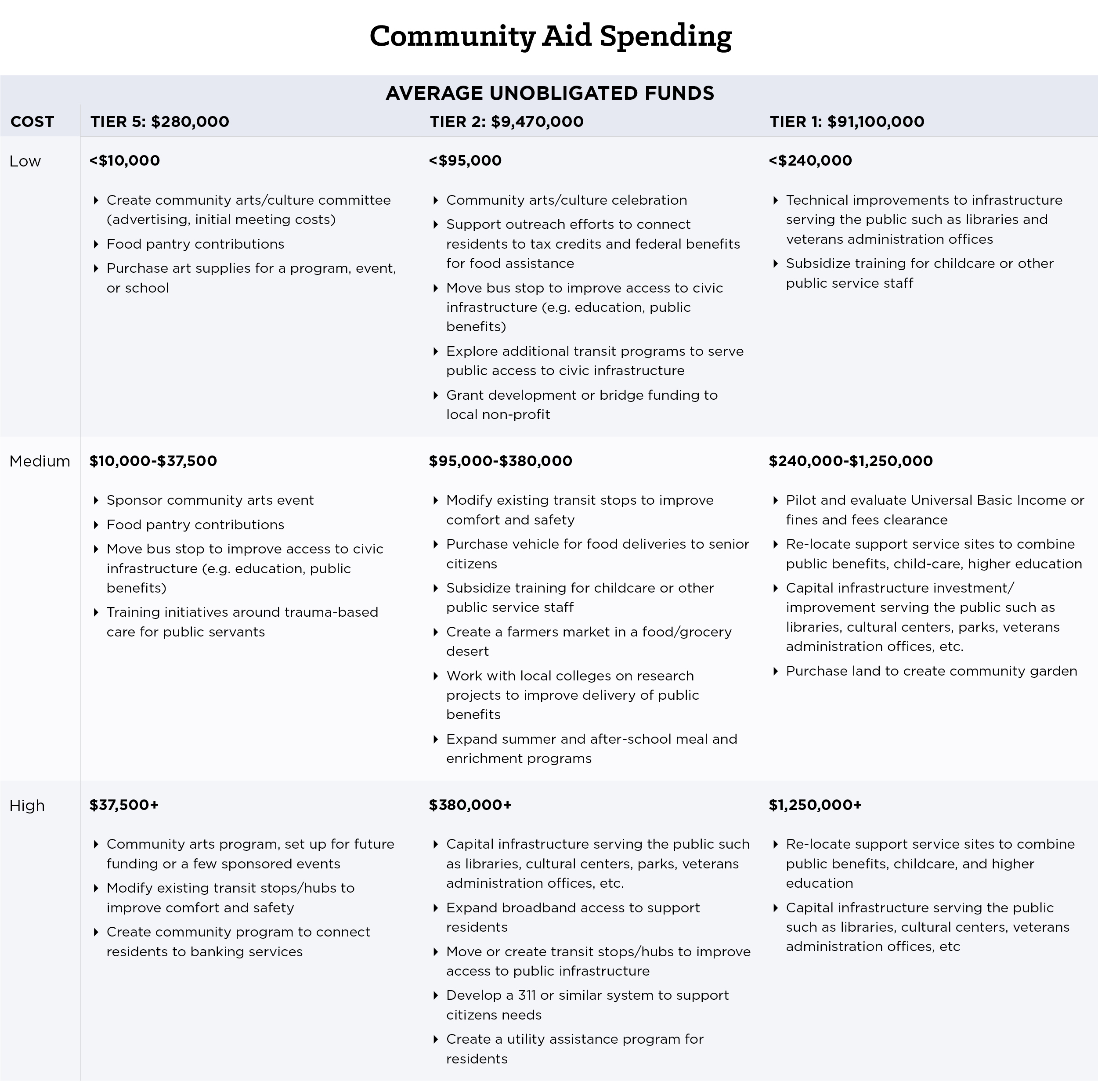

This blog highlights spending ideas in the matrix below on how to meet the 2024 obligations deadline and provides some specific examples of ways they can continue to maintain safe, healthy and vibrant communities with their remaining SLFRF allocations. However, be sure to review Treasury’s Final Rule for compliance and reporting guidance.

Spending Opportunities in Community Aid

The following Spending Category Matrix presents multiple examples for different categories of spending (low, medium, and high cost) that can be utilized by governments of various tiers in obligating their remaining funds. The Community Aid spending category was developed in partnership with NLC, Brookings Metro, and the National Association of Counties for the Local Government ARPA Investment Tracker. This resource is another means for local leaders to find thousands of project ideas across tiers. The programs highlighted below can be applied across multiple categories. In some cases, the program can contract or expand based on the available budget; for example, transit remediation to improve public access to civic infrastructure can vary based on the endeavor.

In some towns, this money can even mean the difference between survival and closure of cherished institutions integral to a community’s history, character, or daily life. It’s important to know, however, that to consider these dollars obligated, the documentation requirements exceed simply allocating the money to nonprofits—check with an expert on the requirements when pursuing this option

Looking Ahead

The once-in-a-generation locally focused federal funding program provided communities with an opportunity to invest in the long-term health and well-being of their residents. These funds can provide further local or regional support by recipients partnering with neighboring municipalities, like surrounding counties, cities, towns and villages, to achieve mutual goals to improve services and meet resident needs. Using these funds alone or in combination with other federal programs, such as the HUD’s Community Development Block Grant and Section 108 Loan program, DOT’s Transportation Alternatives and Thriving Communities Program, or other programs under the Bipartisan Infrastructure Law (BIL), to make capital investments in programs that support families and children or arts and culture for example, can create lasting impacts on our nation’s communities.

Glossary

American Rescue Plan Act (ARPA) is the $1.9 trillion economic stimulus and pandemic recovery legislation signed into law by President Joe Biden on March 11, 2021. This blog and its series focus on the Coronavirus State and Local Fiscal Recovery Funds (SLFRF) program; therefore, authors may use “ARPA” and “SLFRF” interchangeably.

Coronavirus State and Local Fiscal Recovery Funds (SLFRF) is the $350 billion program authorized by ARPA that provides economic stimulus and pandemic recovery funding to U.S. states, territories, cities, counties, and tribal governments.

Allocations are the total funds distributed to state and local governments through SLFRF.

Adopted Budget are dollars distributed to local governments through SLFRF that have been budgeted or committed to specific initiatives or programs.

Spent means the grantee has issued checks, disbursed cash, or made electronic transfers to liquidate (or settle) an obligation.

Obligations are dollars distributed to state and local governments through SLFRF that have been legally dedicated to specific uses, frequently (but not exclusively) through contractual agreements. The Treasury’s recent guidance defines obligations as “orders placed for property and services and entry into contracts, subawards, and similar transactions that require payment.” The Final Rule requires recipient local governments to obligate 100 percent of their SLFRF allocations by December 2024.

Tier 1 local governments are metropolitan cities and counties with populations greater than 250,000. These jurisdictions include states, U.S. territories, and counties but NLC’s focus for this series is on cities. These governments are required to report quarterly, and the last reporting date captured in our data is from September 30, 2023.

Tier 2 local governments are metropolitan cities with a population below 250,000 residents that are allocated more than $10 million in SLFRF funding, and NEUs that are allocated more than $10 million in SLFRF funding. These jurisdictions include counties but NLC’s focus for this series is on cities. These governments are required to report quarterly, and the last reporting date captured in our data is from September 30, 2023.

Tier 5 local governments are metropolitan cities with a population below 250,000 residents that are allocated less than $10 million in SLFRF funding, and NEUs that are allocated less than $10 million in SLFRF funding. These jurisdictions include counties but NLC’s focus for this series is on cities. These governments are required to report yearly, and the last reporting date captured in our data is from April 31, 2023.

Non-entitlement units (NEUs) are local governments that typically serve 50,000 residents or less. Of the $65.1 billion allocated to municipal governments across the country, SLFRF allocated $19.5 billion, or 30 percent, to NEUs. Comparatively, SLFRF allocated $45.6 billion, or 70 percent, to metropolitan cities. Depending on if an NEU is a Tier 2 or Tier 5 recipient, they may have different reporting requirements.

Acknowledgements: Thank you to Julia Bauer, Irma Esparza Diggs, Josh Franzel, Patrick Rochford, Archana Sridhar, and Melissa Williams for their support and review of this blog.